What are the benefits of a High-Deductible Health Plan and Health Savings Account (HDHP/HSA)?

Lower premiums can be one of the most significant benefits of a High-Deductible Health Plan (HDHP). By offsetting the higher deductible, lower premiums can often save participants money in the long run. Another big benefit is the ability to partner an HDHP with the triple-tax advantage of an HSA. This combo can work together to be a powerful savings and investment tool.

However, “deductible” is commonly considered a four-letter word that we’re forced to deal with as an award for becoming a responsible adult. So, it’s understandable that adding the word “high” in front of it can create some red flags. Because of this stigma, it can be hard to make it past the words “high-deductible” to learn about the benefits.

Despite the reputation High-Deductible Health Plans have for being confusing, they’re not any more complicated than traditional plans. For years, studies have shown a serious lack of understanding on the topic of healthcare in general.

For example, Forbes recently reported on a survey conducted with 2,000 Americans who have health insurance. In the survey, nearly half were unable to define “copayment” and “deductible,” and had “fairly significant” gaps in understanding other areas of health insurance as well.

Since knowledge is power, how impactful would it be if that statistic were to improve? Employees could make more informed decisions, and employers could gain some leverage in the area of employee experience and retention. So, let’s look at the details.

What is an HDHP, and how does it work?

An HDHP is a health plan with lower premiums and a higher deductible. HDHP participants can also take advantage of a Health Savings Account to help offset medical costs and save for the future.

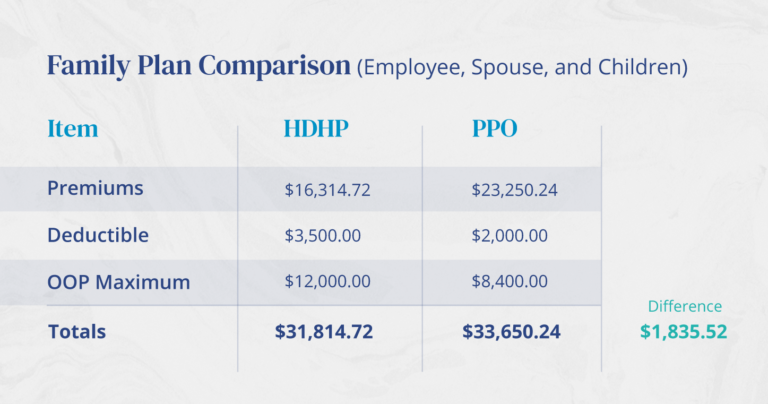

Aside from the textbook definition, how does an HDHP work? The details will vary depending on where you are and which plans the employer has chosen to offer. But let’s look at a real comparison to see how an HDHP compares with a traditional PPO plan:

HDHP vs PPO - Cost Comparison

In the example above, there are a few things to note that are true for most HDHP plans. The premiums are lower, and the deductible is a bit higher. In this instance, even though the out of pocket cost is also higher than the PPO, lower premiums still offset that cost with a yearly savings of $1,835.52.

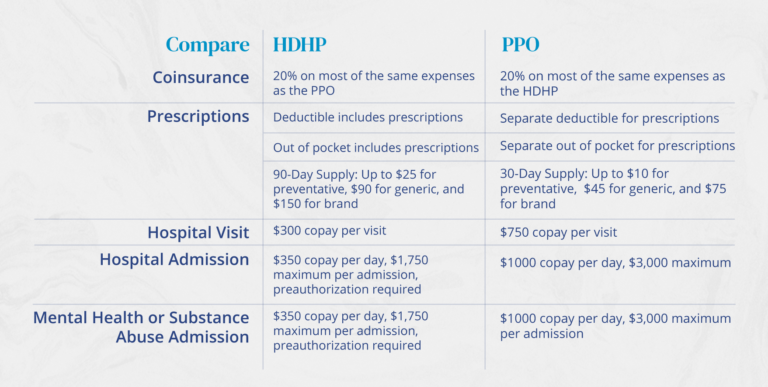

Before getting excited about the savings, there are other things to consider in addition to the base costs like coinsurance and prescriptions, not to mention unexpected hospital visits. Here’s how our example plan would stack up:

HDHP vs PPO - Coinsurance and Out of Pocket Costs

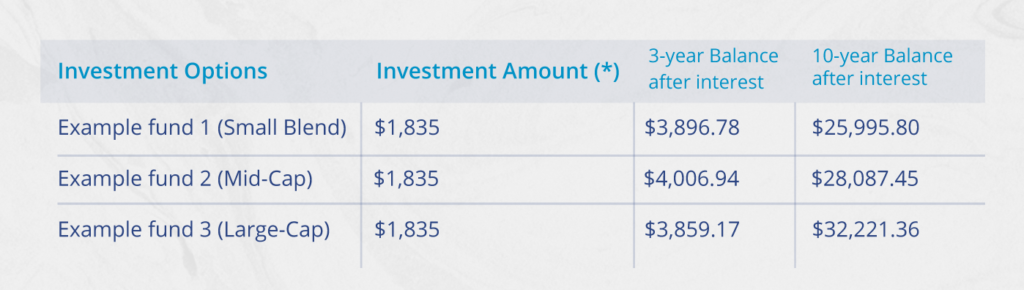

When participants choose a qualifying HDHP, using an HSA becomes an option to help save and invest for the future. So, what if the yearly savings from our example was placed in a Health Savings Account and invested to grow tax free over time? The chart below shows three out of the many investment options participants with this HDHP could choose from. The value estimates are based on each portfolio’s reported rate of return.

HSA Investment Examples

The triple-tax advantaged of Health Savings Accounts make them an ideal savings and investment tool for retirement. In the graph examples, the balance from each HSA account portfolio would be available for the account holder to use penalty free and tax free for qualified medical expenses at any time.

Health Savings Accounts, like the example above, are only available in partnership with an HDHP and not to be confused with a Health Reimbursement Arrangement (HRA). HRAs, along with Flexible Spending Accounts are other types of tax-advantaged accounts employers can offer.

Should you have an HSA? It’s always good to check with your financial advisor when making investment decisions, but we’ve laid the foundation and answered some of the most common questions to help you get started. You can also estimate potential savings for you or your clients with our HSA Savings Calculator.

Brokers can request a proposal or demo: