Comparing three of the most common tax-advantaged benefits:

-

Flexible Spending Account (FSA)

-

Health Savings Account (HSA)

-

Health Reimbursement Account (HRA)

Choosing the account that best fits your needs is essential for getting the most out of your benefits during the plan year, but it can also impact the future. Let’s take a closer look.

What do an HSA, FSA, and HRA have in common?

They are all tax-advantaged accounts. Simply stated, money is deposited into the account before taxes are taken out, lowering your taxable income and increasing your take-home pay.

What are the differences between an HSA, FSA, and HRA?

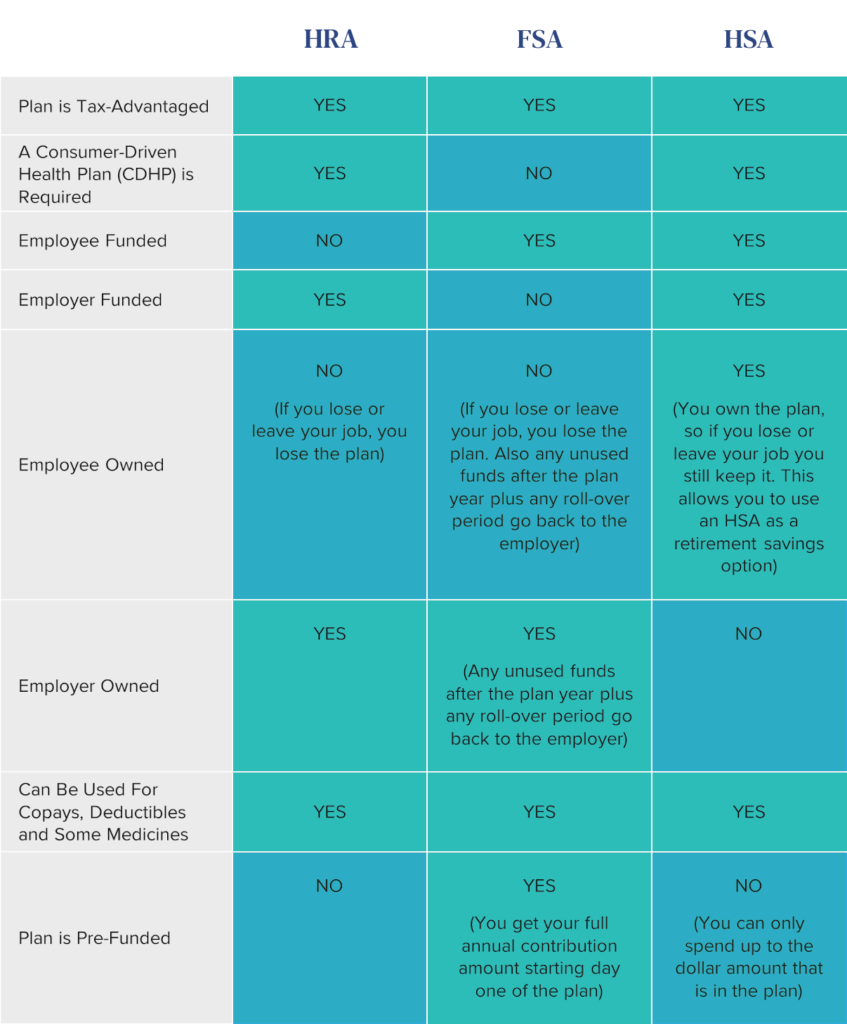

An HSA is the only account owned by the employee. The balance can be invested and carried over to continue growing yearly while an HRA and FSA are employer-owned. Each type of account has unique features that set it apart, and employees can choose the combination that addresses the needs of their specific life situation. To illustrate, here’s a comparison chart:

Planning your benefits is critical.

Decisions like whether or not you are getting married, changing careers, saving for retirement, or starting a family can affect which plan option is best for you. Although planning isn’t something everyone loves to do, considering these major life events will allow you to make sure you have a plan that best serves you and your family.

The bottom line is that it’s worth the extra time to educate yourself and match your goals with the possibilities. Here are a few questions to consider:

- Do you want an account you own and can take with you when you retire or change jobs? Since a health savings account is an employee-owned benefit, you can take it with you or roll it over.

- Are you looking for a pre-funded account that offers the entire balance at the beginning of the plan year? A flexible spending account is an employer-funded benefit that allows you to begin with the balance amount you’ve decided to set aside for the plan year.

- Do you need an account option that your employer funds? A health reimbursement arrangement is a solely employer-funded benefit.

- Is saving for a more comfortable retirement a priority for you? A health savings account offers a triple-tax advantage to carry into retirement. In addition to having the pre-tax advantage, you can invest the balance for tax-free growth potential over time.

Ultimately, with a little planning and education, you can choose a health plan and savings option best benefits you and your family.

Learn more about Health Savings Accounts with our Ultimate Guide.