A Health Savings Account can be a powerful tool to have in your healthcare and retirement toolbox. With the cost of healthcare rising every year, it is becoming a more popular method for investing and saving for future medical expenses. So, knowing how they function has also become a topic of interest for participants and employers. So, let’s look at the details:

What role does the employer play in an HSA?

Employers get to decide which benefits to offer their employees. They balance the possible risks and costs with the value added to their organization and employees. So, whether the employee receives the option to choose an HSA as part of their benefits package is up to the employer.

An HSA adds value for both employers and employees through its tax advantages. If an HSA is offered as a pre-taxed employee benefit, neither side has to pay federal or payroll taxes on the contribution. However, if the employee has to find an HSA outside their employer’s plan, they have to wait until the end of the year for filing deductions.

The bottom line is that employers can bring added convenience of a payroll deduction by offering it as part of their benefits package. Then, it’s the employee’s responsibility to make the decision that best suits them, and the question becomes…

Should I have an HSA?

Just like any other healthcare decision, there are a few things to consider when planning what’s right for you and your family. In this case, a few things to factor in would be current health, medical expenses you plan to incur during the plan year, and what your goals are for having an HSA.

Let’s be clear. Current health doesn’t disqualify you from owning an HSA. But, since an HSA can only be used in partnership with HSA-qualified high-deductible health plans (HDHP), it only makes sense to plan your best move by considering what medical expenses you’ll need to cover along with the details of your plan.

This doesn’t mean that HDHPs are only for people who don’t need to use their insurance plan, which is a conclusion that some jump to. Let’s take a look at some of the features of an HSA along with an HDHP plan comparison, and common concerns for both employers and employees:

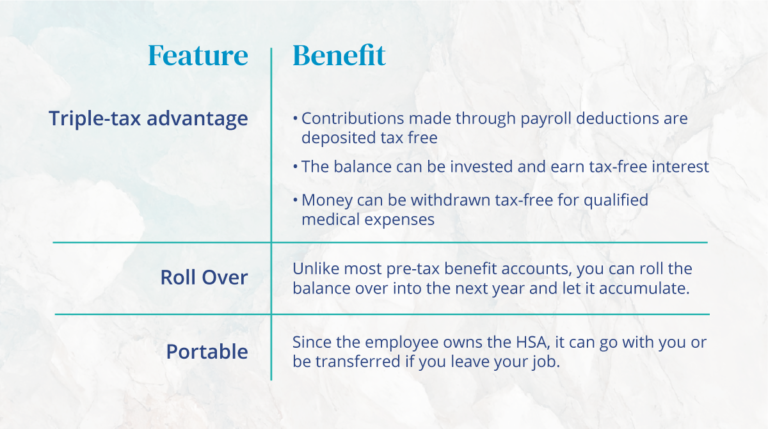

Features of an HSA:

What are the benefits of a Health Savings Account?

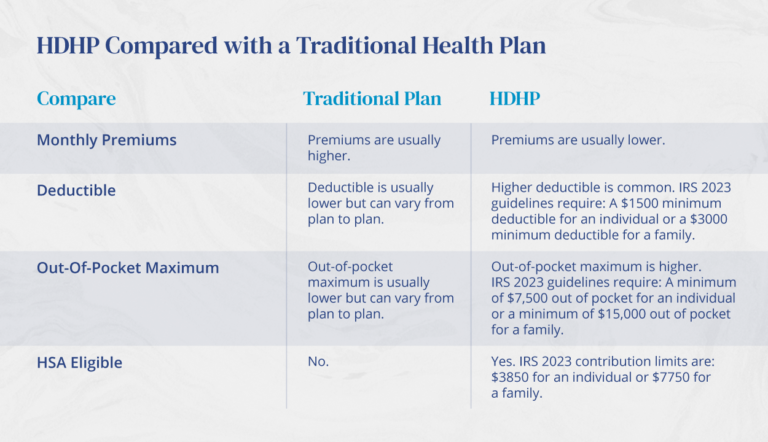

How does an HDHP compare to a traditional health plan?

Use the facts to see how an HSA-HDHP combination might work for you:

Common Concerns of an HDHP:

Employers and employees might have some questions or concerns about High-Deductible Health Plans:

"It's confusing, and I don't have time to figure it out."

A learning curve will be part of any plan you choose. After the first year, it gets easier.

Ameriflex is a great resource and can help answer questions for employers and participants along the way.

We take care of the plan administration and compliance concerns so employers don’t have to.

"An HDHP will cost me more."

Lower premiums can offset your deductible and out of pocket costs. This is where planning ahead comes in handy.

Learn what your plan offers at no cost and take advantage of it. For example, preventative care and preventative prescriptions are covered 100%.

Some employers will match employee contributions. Take advantage of the extra perk.

Use the tax incentives from the chart above to your advantage. HSA funds can be used to reimburse yourself for out of pocket expenses, deductibles, and coinsurance.

Take advantage of tax-free investment growth and roll your balance from year to year to accumulate and save money for future medical expenses and retirement.

Ameriflex HSAs have no account fees.

"I can't afford to invest."

Ameriflex offers a $500 investment threshold, which is lower than most other HSA administrators.

Since HSA investments can grow tax free, it could help save you more for medical expenses in the long-run.

Carefully considering the right benefits options is a critical decision for the employers offering them and the employees using them. For more HSA details to help with the process, visit our HSA Ultimate Guide.