What is a Lifestyle Spending Account (LSA)?

You know those expenses that accumulate throughout the year that make you stop and think, “Shouldn’t my health insurance cover this?”

This is where a lifestyle spending account comes in.

Lifestyle Spending Accounts are also known as Employee Wellness Programs, Employee Wellness Accounts, and other variations of the same terms. In short, it is an account funded by the employer that helps pay for expenses not typically covered by a group health plan. It addresses expenses related to health and wellness, from home office supplies to healthy snacks and gym memberships.

Why offer a Lifestyle Spending Account (LSA)?

Flexibility & Choices:

Lifestyle spending accounts have never been more relevant.

Wellness needs can look different depending on where employees are in life. Not to mention employees are working longer and retiring later, so organizations are experiencing a greater range of ages in the workplace. Therefore, flexibility and choices are two characteristics that have become more popular in the world of employee benefits. This is what an LSA provides.

In a LinkedIn study, 56% of employers said they’re updating their policies to appeal to a multigenerational workforce. With consumers taking more interest in healthcare decisions, an LSA provides an easy way for them to accomplish this.

Finding & Retaining Top Talent:

In addition to adding flexibility and choices, the same LinkedIn study said 77% of employers reported focusing on employee experience to increase retention.

So, it only makes sense to recognize that employees are at different stages of life. Depending on where they are, health and wellness look different. A lack of resources to help take care of those issues that pop up can lead to searching for answers by switching jobs.

Turnover is costly, but how can employers be sure that benefits like an LSA can help? As shown in the study, there was a 56% lower attrition rate for companies rated highly in the compensation and benefits category. All things considered, a customized LSA plan can help meet the wellness needs of your employees and make a difference.

Employee Productivity:

Despite the value it provides employees, offering a Lifestyle Spending Account isn’t an entirely selfless act. As this article in Forbes Magazine outlines, investing in corporate wellness is also an investment in a company’s bottom line.

Employee experience has even earned a nickname. The ‘Ex’ Factor is how employers are working to find and keep top talent in their organizations. Research from various resources shows employee wellness programs are one way employers are working to improve employee engagement and employee retention.

How Do Lifestyle Spending Accounts work?

Employers fund the account and decide the annual reimbursement limit and allowable expenses for employee groups. Then, Ameriflex handles the administration and support.

Employees are not required to use the Lifestyle Spending Account, but it’s there for them if they need it. They can use any percentage up to the maximum allowed amount on any combination of expenses they choose. Only the amount the employee uses is taxable as income.

Who can participate in the LSA?

Any employee or employee group designated by the employer can participate in an LSA.

How to spend the LSA funds:

After the employer sets a reimbursement limit, employees pay for eligible expenses and submit a receipt for the product or service.

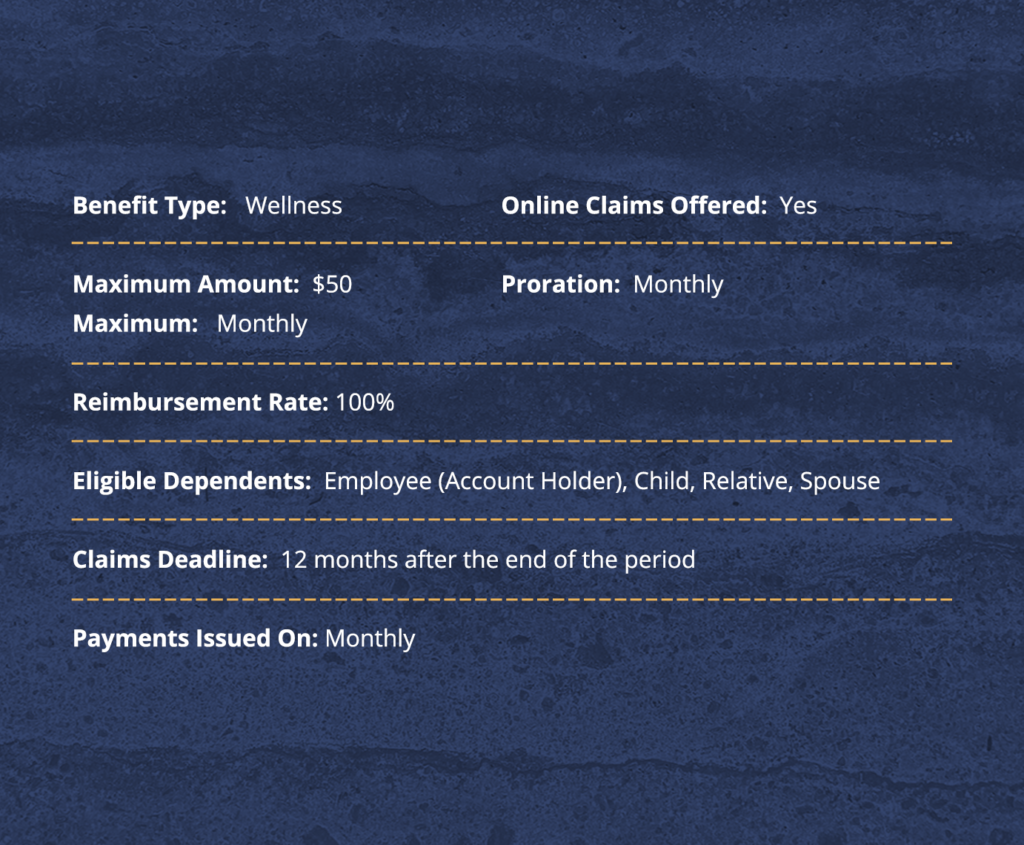

Lifestyle spending Account (LSA) Plan Example:

Administration:

How do I submit receipts for LSA reimbursement?:

Receipts submitted for reimbursement must include three things:

• the product or service purchased,

• the date of purchase or service,

• and the purchase amount.

Where do I find support when I have a question about my LSA?:

Ameriflex provides support via its website, phone, and mobile app.

Will my LSA balance carry over at the end of the year?:

When planning the account, the employer chooses if carrying over a balance will be an option.

Compliance:

How do taxes work with an LSA?:

The amount employees use is considered income and taxable as such.

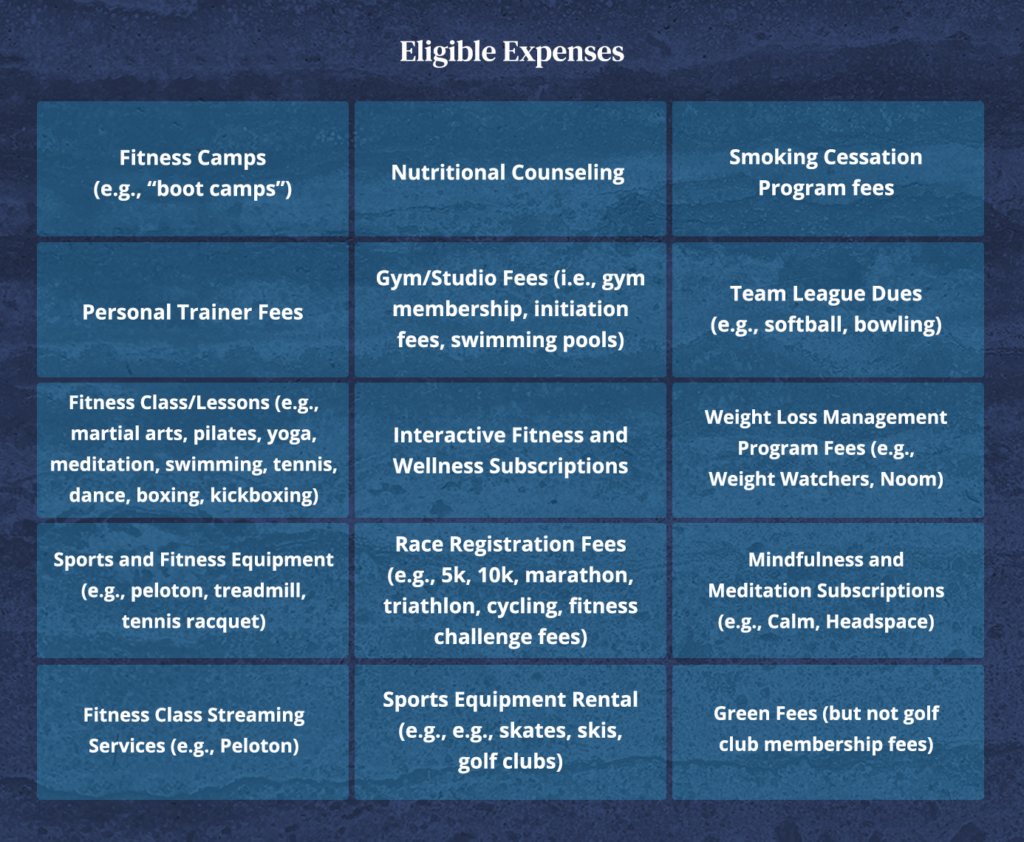

What expenses are eligible with an LSA?

Employers can choose a variety of nonmedical items that help improve the health and wellness of their employees. To be covered, expenses must be related to physical, mental, emotional, and financial wellness items not usually covered by the company’s healthcare plan. These include but not limited to:

Gym Memberships

Home Gym Equipment

Nutritional Supplements

Utilities

Groceries

WiFi

Life Coach

Holistic Healing

Nutritionist

Spa and Salon Treatments

Counseling

Therapy

Weight Loss Programs

Camping

Hunting and Fishing Licenses

Cosmetic Dentistry

Cooking Classes

Pet Care

Are there any expenses considered ineligible?

Currently, there are no laws that address Lifestyle Spending Accounts. However, it’s prudent to leave expenses covered by tax-advantaged plans out of an LSA. Tax-advantaged expenses include:

Dependent Care

Commuter Benefits

ID Theft

Tuition Assistance

Student Loan Reimbursement

FAQ:

How is a Lifestyle Spending Account different than a Health spending Account (HSA)?

An HSA is a tax-advantaged account only available with a high-deductible health plan. Funds in the HSA are usable for IRS-defined healthcare expenses.

Differences between LSAs and HSAs:

A Lifestyle Spending Account is not a tax-advantaged account, and the employer chooses what items they will cover. To learn more about Health Savings Accounts, read more here.

How is a Lifestyle Spending Account different than a Health Reimbursement Arrangement (HRA)?

An HRA is not an account. It is an agreement that allows the employer to provide tax-free reimbursement for qualified medical expenses. HRAs are also subject to ERISA compliance guidelines.

Differences between LSAs and HRAs:

A Lifestyle Spending Account is a form of account with a pre-set reimbursement limit, it is not tax-advantaged, and it covers nonmedical expenses the employer outlines in the plan.

To learn more about Health Reimbursement Agreements, read more here.

What happens if an employee leaves before the end of the fiscal year?

Ameriflex will administer the designated runout period if any, and access to funds is limited once that period has lapsed.

Are employees required to offer the same amount to all employees?

No. Employers can differentiate between employee groups and designate different amounts for different employees.

Can I add an LSA to my benefits package after Open Enrollment?

Yes, an LSA can be added at any time of year.

What information should employers provide their employees?

Ameriflex provides educational resources for employers to distribute.

Can the employee contribute?

No.

Can the employee use their Ameriflex Debit Mastercard(R) card?

Yes. However, it is not encouraged. Since Lifestyle Spending Accounts cover nonmedical items, the card is likely to decline often for this type of expense.

Is there an IRS-imposed limit?

No. The limit is set only by the employer.

Would this account type qualify for Non-Discrimination Testing?

This benefit type does not fall into typical Section 125 sanctions.

How can I learn more?

Check out our LSA Case Study, watch our LSA Webinar, or contact us to learn more.