What is a Health Savings Account?

HSAs Explained

High-deductible health plan participants use a health savings account to save tax-free earnings to pay for qualified medical expenses. It can be used to pay for current medical expenses or invested and saved for later. A health savings account is a personal account for saving and investing. Employees can contribute pre-taxed earnings to their HSA to pay for current or future medical expenses such as copays, deductibles, over-the-counter medications, and prescriptions.

There is no use it or lose it rule for an HSA, and the balance carries over from year to year. So, it can continue to grow, is available when needed, and can also be invested. An HSAs tax-free growth can be an added asset in planning for retirement. Only employees enrolled in an HSA-qualifying high-deductible health plan (HDHP) can enroll in an HSA, and employers receive FICA tax savings for every employee who contributes to an HSA.

The Value in an HSA

No matter what an employee’s level of experience with an HSA, your most important job is to make them understand the value. You’re going to get the most out of it by empowering your employees to make the most out of it.

Let’s start with the basics.

HSAs Skimmed

Take it to the limit

Employees who decide to enroll in the company’s high-deductible health insurance plan (HDHP) can qualify for an HSA. This helps to offset the cost of their HDHP, and give them some tax benefits in the process.

For 2024, the IRS has set (for an individual) an HSA contribution limit of up to $4,150 or up to $8,300 for family coverage. For anyone 55 or older anytime this year, they will be able to contribute an extra $1,000.

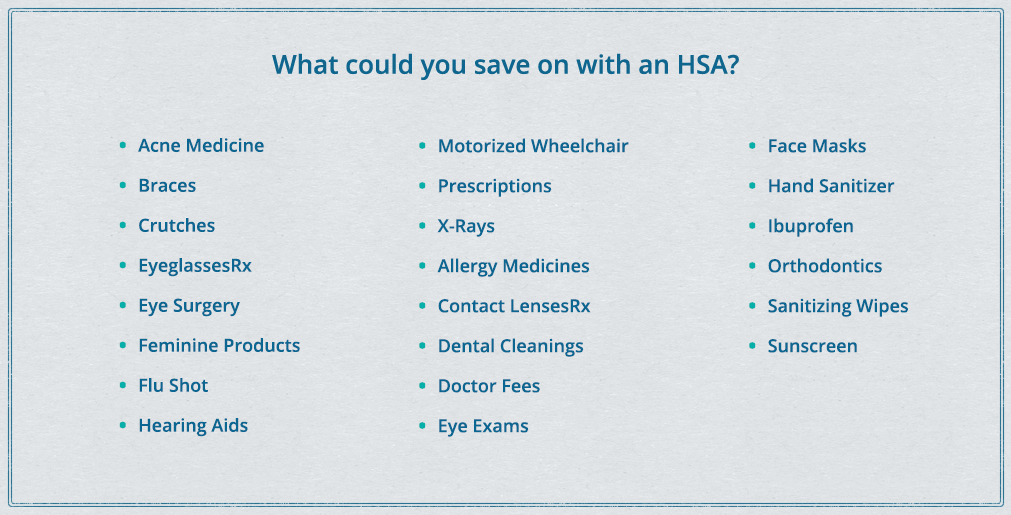

It’s important for your employees to know exactly what is covered by their HSA, because they will be responsible for verifying the eligibility of purchases themselves. A lot is covered, so sometimes it is easy to make assumptions. For example, gym memberships, while health-related, are not covered.

Want to see more of what’s covered? Here is a list of what is covered with a link to the HSA store.

5 reasons to offer employees an HSA

HSAs are a big investment, both in money (depending on whether or not you’re contributing) and in the time to get the offering up and running. If you need to sell the concept to the top brass, or to encourage employees to use the HSA program you’ve recently set up, start with these five reasons:

1. “Pay as You Go” Healthcare Help

Imagine you’ve been delaying that eye checkup because you’re not on board with an HSA. Well, here’s the scoop: an HSA is like a “pay-as-you-go” account tailor-made for medical expenses. It covers stuff like deductibles, copays, and other health costs your insurance might not handle.

Just remember, you can’t use it for your insurance premiums.

2. You're the Boss of Your HSA Destiny!

In the world of health accounts, HSAs give you the ultimate power. Once you stash money in there, it’s all yours to command. No micromanaging from the company’s end – it’s your show.

You call the shots on what you spend it on. Sure, the admins might offer tips, but at the end of the day, it’s your call.

And here’s the sweet part: unlike those other accounts with “use-it-or-lose-it” rules, your HSA balance sticks around year after year. No need to rush to spend it all. Plus, even if you switch jobs, your HSA stays loyal to you. It’s like having a trusty sidekick for life.

3. Unlock Your HSA's Investing Superpower!

Here’s a gem many of us overlook: with HSAs, you can supercharge your savings by investing a chunk of your funds. Yep, we’re talking about diving into mutual funds, stocks, and other investment goodies to make your money work harder for you.

This is huge, especially if your company doesn’t offer a 401(k) or IRA with matching contributions. With HSA investments, you can turbocharge your savings without relying solely on what your employer chips in. It’s like giving your future self a serious financial boost.

Sure, there’s risk involved, just like with any investment. But here’s the kicker: similar to 401(k)s and Roth IRAs, your HSA investment returns are shielded from pesky long-term capital gains and dividend taxes. It’s a long game worth playing.

4. HSA: The Ultimate Tax Hack

Alright, listen up, because this is big: with HSAs, you’re basically giving the IRS the slip. Here’s the lowdown:

First off, your HSA contributions are like secret agents – they dodge taxes like pros. You stash your cash in there before Uncle Sam even knows it exists. And when you use that money for eligible expenses? Boom, tax-free.

But wait, it gets better. HSAs aren’t just a one-time tax dodge – they’re a triple whammy of tax savings. You dodge federal income tax, Social Security tax, and Medicare tax. That’s like winning the tax lottery.

Let’s break it down. Say you’re making $50,000 a year. You max out your HSA contribution at $3,500. In the eyes of the taxman, you’re only earning $46,500. Cha-ching! You’re not just saving for the future; you’re slashing your tax bill too.

And get this: while 401(k) and IRA contributions dodge state and federal taxes, they still get smacked with that FICA tax. But not your HSA contributions – they’re FICA-free, giving you even more bang for your buck.

And hey, it’s not just you who benefits – your employer gets a tax break too. Win-win!

So, in the world of tax hacks, HSAs are like the golden ticket. Time to cash in.

So while 401(k) and IRA contributions will avoid state and federal taxes, they are still going to be hit with that FICA tax.

This tax saving advantage extends to the employer too. Not only does the HSA have a lower administrative burden, but employer contributions to employee HSAs are tax deductible as a business expense

5. You Can’t Afford Not to

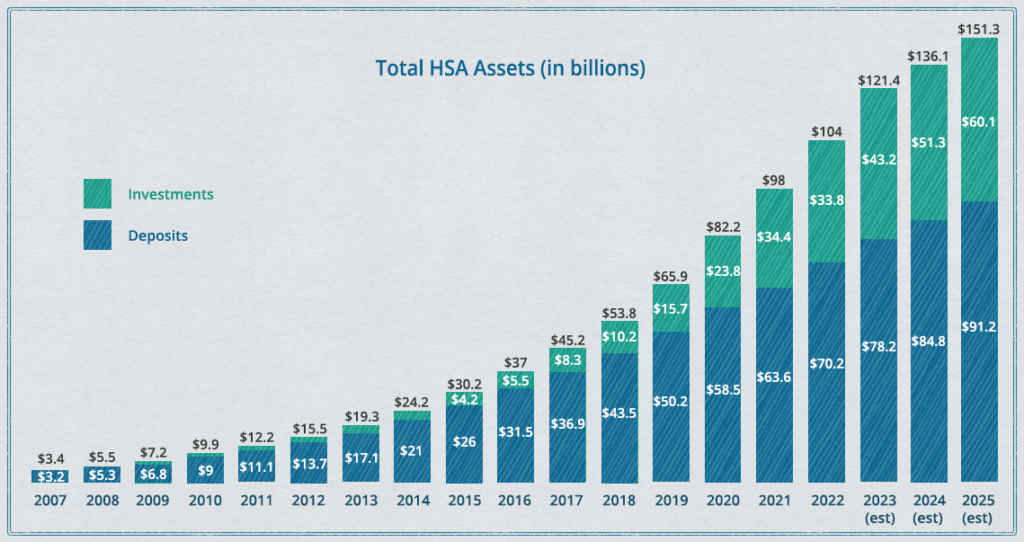

As HSA offerings become more and more common, top tier talent is coming to expect benefits such as an HSA plan from their employer. HSA research firm Devenir found that health savings accounts grew to over 36 million accounts in 2023, and those accounts held $116 billion in assets — a 17% increase over the year before.

Why are HSAs on the rise? Simply put, it’s a competitive economic environment. In light of the pandemic, employers are having to do more in order to attract talent, and to keep the talent they have. This isn’t a short-term trend, either — Devenir projects that the HSA market will exceed 40 million accounts by the end of 2025, holding over $150 billion in assets.

HSA Administration: 4 Steps From Kick-off to Cash-Out

Step #1. Get your HSA plan rolling.

No need to jump through IRS hoops to set up your HSA plan. Here’s how to get started:

First off, your team needs to be covered by a qualifying HDHP ( High Deductible Health Plan) to be HSA-eligible. Once that’s sorted, establishing an HSA is a piece of cake. Your team can set one up anytime after becoming HSA eligible, following state trust laws.

Got your HSA administrator picked out? Great! They’ll handle the setting up of your HSA accounts for your team once you’ve got your enrollments in.

Q: What is the job of an HSA trustee/custodian/administrator?

A: To hold HSA assets in a secure account.

Q: Can employees switch HSA administrators??

A: Yes. A qualified individual is under no obligation to keep their funds at one institution. If you have an employee request to transfer their funds, have them get in touch with the provider, who will handle the transfer. Your employees can also have more than one HSA. As long as the aggregate of their contributions doesn’t exceed the annual maximum contribution limit, they are free to have two, three, or more separate HSA accounts if they wish.

Q: Can an ex-eligible employee still snag an HSA?

A: It’s a bit of a gray area. While possible, it’s smoother sailing if they jump on it ASAP after becoming eligible.

Q: Can couples share an HSA?

A: No, HSA’s are solo ventures. Married folks just share the family contribution limit.

Note: in a family HSA, the funds can be divided in any manner the couple likes – they can even allocate 100% of their combined annual contribution limit to one spouse.

Q: Can employer contributions vary?

A: Flexibility is the name of the game. You can pick a plan that suits your company, from lump sums to matching employee contributions. You have a few options, all of which are just as valid as the other:

- Yearly or monthly lump sum payments

- Per pay period payment

- Matching an employee’s contribution

- Periodic lump sums

- None at all

The relative versatility for both employer and employee is one of the many reasons that they are a strategic benefit choice — HSAs are what you make of them.

Q: What is nondiscrimination testing?

A: HSA employer contributions are subject to Section 125 Cafeteria Plans, which means that employers are also subject to the IRS guidelines’ nondiscrimination component. This means that HSA plans cannot unfairly benefit employees who are more highly compensated — essentially, you can’t offer your Executive team a better HSA match than someone who recently joined the company in a lower level position.

It’s about playing fair. HSA plans shouldn’t favor higher-paid employees over others.

Q: Can I set up HSAs for my team without their say-so? : A:Technically, maybe. But it’s way smoother- and nicer to get their input and avoid any headaches down the road.

HSA Beneficiary Designation Form

When your team signs up for an HSA, they’ll need to fill out a beneficiary designation form. It’s one of those, “hope you’ll never need it, bit gotta do it,” situations. If the HSA passes away, the balance in their account heads to the people they’ve named as beneficiaries.

You can name more than one person, divvying up the goods with percentages. For instance, you could split your HSA between your husband and mom 50/50. Just remember, only a spouse can receive the HSA balance tax free.

Pro tip: Don’t let your ex cash in on your success. Life happens, and it’s easy to forget to update your beneficiary after major events like divorce or loss. But it’s crucial to keep it current to ensure your account ends up in the right hands.

Step #2. When, and How Much?

Helping an employee set their contribution rate

Once your employee has established an HSA, the next step is to determine the maximum amount they can contribute, and when those contributions can be made.

When helping your employees set their contribution limit, you’re going to want to highlight a few points for them:

- Their contribution is limited by the maximum contribution amount for the year, depending on if they’re single or using family coverage

- Someone who is HSA eligible the full year can only contribute 1/12 of the overall coverage maximum each month, because the limits are applied on a monthly basis

- The full-contribution rule is a special rule that allows someone who is only HSA-eligible for part of the year (December 1 is the cut-off) to contribute the full amount

- An additional annual “catch-up” amount can be contributed for anyone who is 55 or older by December 31

Q: Do I have to contribute to my employees’ HSAs?

A: No. While it’s not mandatory, chipping in can boost participation and score the company some sweet tax savings.

Step #3. Helping Linda from the Corner Cubicle Become “The Wolf of Wall Street”

Choosing Investments for HSA Funds

Once HSA account holders have a certain balance built up in their accounts, they generally may choose how to invest the money they’ve accumulated which exceeds that threshold amount. For example, if their account custodian requires they have $5,000 in their account before they can invest, every dollar built up over that $5,000 is a dollar that can be invested.

This is the intimidating part of having an HSA – sure, your employees are getting a huge benefit just by sitting back and letting the funds accumulate. But for those who want to do more, it is well worth your time to educate them on the basics of channeling their inner “Wolf of Wall Street” (all of the investing savvy, none of the ethics violations) and working their HSA for all of its capabilities.

Typically, that money is invested in mutual funds, stocks or bonds. Here are some things you can’t use an HSA for — investing or otherwise:

- Life insurance contracts

- Collectibles (art, antiques, gems, stamps, etc)

- Property

- Collateral/security for a loan

- Borrowing or lending of money

If an employee does use their HSA for any of these prohibited transactions (other than pledging his or her HSA as security for a loan), then the HSA would be disqualified and terminated as of the first day of the taxable year in which the transaction occurred. They are then taxed as if the entire balance of the HSA were distributed on the first day of that taxable year.

The exception is if the account holder uses their HSA as security for a loan. In that case, the pledge would be a prohibited transaction, but the specific sanction for that misuse of funds is that only the amount pledged (not the entire HSA account balance) would be treated as a taxable distribution.

Step #4. Answering Employee Questions

Inevitably, your employees are going to have questions. The more they use and utilize their HSAs, the more questions they will have. Here are some of the most common questions that come up as employees begin using their HSA funds:

Q: What if I accidentally use my HSA debit card for a non-medical expense?

A: If an HSA owner withdraws money to pay an expense that he or she reasonably, but mistakenly, believed to be a qualifying medical expense, they can avoid tax consequences by returning the funds to the HSA before Tax Day (generally, April 15) of the year in which they discovered the mistake.

HSA owners are solely responsible for reporting their distributions and medical expenses to the IRS, and substantiating them. Substantiating employee expenditures is not the job of the HSA administrator or contributing employer. If any portion of the HSA account owner’s total distributions does not meet all the requirements for spending HSA funds, the HSA owner must include that portion as taxable income; they will likely be required to pay a 20% penalty.

Senior Skip: If the HSA owner is aged 65 years or older, they are not subject to the 20 percent penalty on any HSA distributions. This is also true if the HSA account owner becomes disabled.

Q: If I invest my funds, can I still use them to pay medical expenses?

A: Yes. Check with your account custodian for their specific policies on moving funds to cover a medical expense – the money may not be available to account owners immediately. Account owners should be aware of how they can put their invested money back into cash available to use, and how long that process will take.

Q: How do I access my HSA funds?

A: The way in which your employees can access their HSA account funds will differ, depending on what institution your company has serving as its HSA trustee or custodian.

Some offer access that is similar to having a checking account, while others, like Ameriflex, also offer access through the convenience of a debit card. This allows employees to easily pay for health care in a variety of environments, so long as they have the funds readily available in their account.

Note: Employers must notify employees that other methods of access to their HSA funds are available. For example, in addition to the debit card, the HSA account holder must also be aware of and able to access the HSA funds through online transfers, withdrawals from ATMs, or check writing.

Q: Can my spouse access our HSA account?

A: Yes. Although an HSA is an individual account, an HSA account holder can designate other individuals to withdraw funds, as long as they do so in whatever manner the HSA trustee/custodian has set up.

Make sure your employees educate their spouses also, so they understand the purpose of an HSA when using funds: an HSA account holder can take distributions for any purpose — but only distributions for qualified medical expenses are tax-free, and penalties may be assessed if distributions are used for non-medical expenses.

Q: Can an HSA be used for mental health expenses?

A: Yes. This is one of the best benefits of an HSA — it helps to bridge this important gap that often isn’t covered by other means. HSA funds are available to cover mental health, and this can ease the burden of getting the help your employees need.

How can Ameriflex help?

HSAs are a relatively low administrative burden once they’re up and running. But they still need a watchful eye and expertise to keep up with current laws and legal interpretations.

It can be helpful to have an expert HSA provider on your side, one who understands your best interests and fights for them through changes both big and small.

As an HSA provider, Ameriflex provides award-winning service that includes:

Multiple, easy-to-use options for access and account management of your employees’ HSA funds.

A single point of contact for plan administration. This allows for Ameriflex to be a knowledgeable advisor, able to evolve your plan over time to best suit your needs and bottom line.

A plan that works for you and your employees, even if you were to change HDHP providers.

If that plan involves multiple accounts, we’ll eliminate the hassle of multiple cards for your participants. We can administer your HSA, Limited Purpose FSA, and HRA — all on one card.

The ease of the Ameriflex Mobile App, where participants can access their account from anywhere. Check balances, check on the status of a reimbursement, and more all from their mobile phone.

Take your administrative burden from low to zero with a partner dedicated to keeping you constantly up-to-date on the latest legislative developments, alongside the technology and ease of use that keeps your plan running smoothly for employees.