What is a Flexible Spending Account?

A Healthcare Flexible Spending Account (FSA), along with its siblings, the Dependent Care FSA, the Limited Purpose FSA, and the Commuter Reimbursement Account (CRA), is one of the smart and easy ways employees can get out in front of rising healthcare costs and medical bills, saving money. FSAs are set up as tax-advantaged accounts, so participants can save up to 40% on thousands of eligible everyday expenses.

Why does an organization need a FSA option in its benefits package?

An FSA can be a strategic tool for your organization, offering financial advantages to both employees and employers, while contributing to a positive workplace culture and attracting top talent.

One in four Americans report in multiple polls that the biggest concern facing their families is high medical bills. It is not as uncommon as people think for families with insurance, and without any major medical issues to struggle and stress over mounting bills .

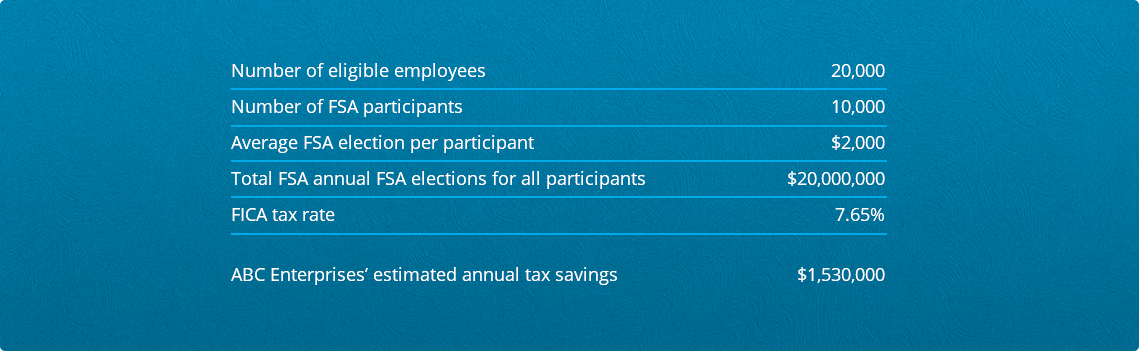

Because FSAs are pre-taxed, the taxable incomes of your employees are reduced to the point where you have a tax-saving opportunity on payroll and FICA taxes equal to that of the tax on the employee’s payroll deduction. Essentially, it’s a no risk, no reward situation: the more employees you have participating, the greater the FICA tax savings.

Sample employer savings: Let’s say that ‘ABC Enterprises’ has an FSA with Ameriflex.

Let’s run through their numbers:

What is FSA Eligible?

Eligible expenses include those related to medical, dental and vision that are not covered or previously reimbursed by an insurance plan. Need to know what an FSA can be used for? Do you know where you can purchase items with your FSA card? Here is a comprehensive list of expenses and links to the FSA store.

What are the Different Types of FSAs?

The most common FSA is a General Purpose FSA, where any qualified medical expense (find the full list here), can be expensed through an FSA account. Other FSA options that you can combine with, or have as standalones, are:

Dependent Care FSA: Paying for childcare or dependent adult care is a burden that the Dependent Care FSA takes care of for your employees. This includes anything from daycare, summer camp, and of course, the care of elderly dependents. Because the cost is deducted pre-tax from employees’ paychecks, they have the potential to save thousands each year on taxes.

Limited Purpose FSA: This type of FSA helps an employee save on vision and dental costs, similarly to how the General Purpose FSA works – the employee estimates how much they will spend over the year, and elect for that amount of coverage. A percentage is then automatically deducted from their paycheck.

Commuter Reimbursement Account: A CRA helps to set aside pre-tax dollars towards parking and mass transit expenses. Employees decide on a monthly basis how much to contribute, and then unused funds roll over to the next month – however, the funds are not portable and don’t “commute” with them to a new job.

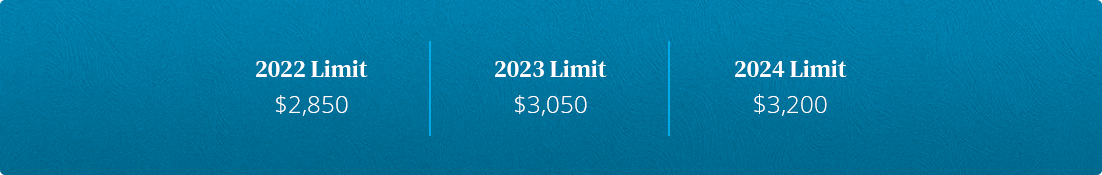

Limitation on health FSA salary reductions

There is a limit imposed on annual salary reduction contributions to FSAs, effective for plan years beginning in or after 2013. For the 2024 plan year, the limit is $3,200. Again, failure to comply could have consequences – a plan offering a health FSA that fails to comply with the limit will lose its tax-favored status.

Q: What contributions are subject to the limit?

The limit applies to health FSA salary reduction contributions. Nonelective employer contributions to a health FSA, like matching or seed contributions, flex credits, or other contributions of that nature generally don’t count towards it.

Q: Who counts as a spouse?

For federal tax purposes, the term “spouse” includes all legally married same-sex or opposite-sex spouses. Individuals in registered domestic partnerships, civil unions, or similar relationships are not considered spouses.

Myths and Misconceptions Employees Have about FSAs:

How to reply: You can’t not afford it! The savings alone make it more affordable than paying out of pocket. What you can’t afford is hefty medical expenses for you and your family – with the FSA, pre-tax dollars (aka money saved) are coming out of your paycheck before you even have a chance to miss it. Then, you have your full election amount available to you from day one, to cover everything from broken legs to cold medication.

aka the use-or-lose-it rule

How to reply: The anxiety behind this rule is completely understandable. Under it, contributions that have not been used to reimburse expenses incurred during a coverage period (usually a 12-month period) generally cannot be carried over to a subsequent plan year, and must be forfeited, unless an exception applies (see below). However, there are many ways to use up your FSA money before it has to be forfeited, if you’re organized and thoughtful in your approach – and exceptions to help you get the most out of it before funds expire are commonly offered by companies.

FSA Example

Every year, Pamela’s employer makes a $500 seed contribution to each employee’s calendar-year health FSA (yay!). For 2024, Pamela elects to put 2,700 toward her health FSA salary reductions, which meets the limit for the year. She receives her employer’s seed contribution, which means that her total health FSA contribution amount reaches $3,100. This will not violate the limit, as long as the $500 seed contribution is not received as cash or taxable benefits.

Now, if we follow Pamela’s story a little further, we find that her employment is terminated mid-year. She elects COBRA under the health FSA, and pays monthly after-tax premiums for her COBRA coverage for the remainder of 2019. Although Pamela will contribute more than $2,700 to her health FSA for 2019, her COBRA premiums are paid on an after-tax basis and will not be considered “salary reductions” subject to the limit.

Exceptions to use-it-or-lose-it:

Carryovers: An IRS guidance issued in 2013 allows health FSAs to offer carryovers of up to $610 at the end of a plan year to be used in the next plan year.

Grace period: Another exception allows plans to provide a 2.5 month grace period following the plan year. During the (amazing) grace period, participating employees can access unused amounts to pay or reimburse expenses for qualified benefits.

Qualified reservists: There’s a third exception for certain employees who are qualified reservists (called to active duty), which allows health FSAs to make some distributions.

While the use-it-or-lose-it rule may seem harsh and cause anxiety for some employees, really it is just ensuring that employees who participate in a health FSA will bear a risk of loss to what they would experience if they were paying premiums under an insurance policy. As an employer, it means that any forfeitures will be a gain under the health FSA that can offset losses to the plan.

Myths and Misconceptions Employees Have about FSAs:

How to reply: Unfortunately, most of us get sick, or have some other malady befall us at some point. Healthcare costs tend to be something you don’t think about until you have to. A transparency rule passed in April of 2018 by the Centers for Medicare and Medicaid Services required hospitals to post prices online — this shed some light for the public on exactly how high seemingly simple health issues can run.

FSA Example

Tara makes salary reduction contributions of $1,200 in her first plan year to a health FSA that does not provide for exceptions like carryovers or a grace period. During that plan year, she incurs only $1,000 of eligible medical expenses. That unused $200 is subject to the use-it-or-lose-it rule and cannot be carried over to her next plan year. In other words, Tara must forfeit her $200.

Stories began breaking in early 2019 when hospitals began adhering to the rule showing how vast the disparity in prices could be, depending on where you end up — for example, treating a headache without major complications cost $82,966 at a hospital in Florida, with lower ranges hitting at around $17k and $23k. Working alongside insurance, an FSA will help you to mitigate costs of a medical episode, so you can move on with your life.

Flexible Spending Accounts (FSAs) also provide coverage for unexpected essentials such as feminine products, over the counter medications, and sunscreen, broadening their scope to address a diverse range of healthcare-related expenses.

Setup & Administration

Who funds a FSA?

To pay approved claims made by plan participants, employers may set up a funding arrangement with a third-party and provide a bank account from which the claims amounts can be debited.

Claims must be paid with employer money, which means that third-party providers, like Ameriflex, are required to collect a single, lump sum deposit (sometimes referred to as a ‘prefund’), which will be set aside to ensure that claims are paid promptly and with the correct funds.

While we can’t speak specifically to what other companies may offer, to give you an idea of what is available, we’ll go over what funding options Ameriflex gives. There are a few different options to choose from.

Prefund Funding Options

To help businesses pay for claims activity, Ameriflex holds your prefund to cover the estimated claim amounts that might have to be paid before we are able to invoice you and debit from your bank account. The prefund amount is based upon Ameriflex’s potential claims exposure, and all prefunds are returned upon client termination of services with Ameriflex (minus any balances owed, of course).

If you’re sweating at the thought of handing over the entire chunk of change all at once, there are three preferred funding options, which can be a flexible alternative to a traditional flex plan funding arrangement. Instead of paying a single, upfront prefund, employers can stagger their funding deposit into small increments, paid over the course of the plan year.

The fine print: When utilizing this option, a 5% add-on is applied to each individual transaction. This amount is then applied toward the employer’s funding balance, which accumulates over the course of the plan year as claims are made, with the target funding deposit being 5% of total annual plan elections. There are three options for pre-fund deposits:

- Daily Preferred ACH/Debit: No up front prefund. Clients are billed for Claims Activity with a Network Processing Fee per transaction, starting at 2.996%.

- Weekly Pre-fund ACH/Debit: A prefund deposit of 1/12th total annual elections held by Ameriflex. No need to send payroll deductions to Ameriflex! No additional fees! Weekly Claims settlement happens automatically without need to send any physical checks!

- Weekly Preferred ACH/Debit: No up front prefund. Clients are billed for Claims Activity with a Network Processing Fee per transaction, starting at 3.997%.

Who can participate in a healthcare FSA?

Generally speaking, participation in a health FSA may be extended to any common-law employee of the employer. Most employers design their health FSAs so that they are only open to employees who are also eligible to participate in the major medical plan. This is because health FSAs generally (there are some exceptions if it’s integrated with another group health plan) must qualify as excepted benefits in order to comply with healthcare reform.

In order for your FSA to qualify as excepted benefits, you have to offer employees other non-excepted group health plan coverage – like major medical coverage – for a full year. This requirement is what the lawyers refer to as “the Availability Condition.” It’s what the rest of us call a good name for the next Mission Impossible movie. “A health FSA’s failure to qualify as an excepted benefit could result in excess taxes of $100 per participant per day or other penalties under healthcare reform, unless the health FSA is integrated with another group health plan under the same rules that apply to HRAs,” says Ameriflex Senior Counsel Donna M. Wilkinson.

Sidebar: Limited-scope dental/vision health FSAs will qualify as excepted, whether or not the availability condition is met. Make a mental note that this does not count for many HSA-compatible limited purpose health FSAs, which reimburse preventative care expenses as well as dental and vision care. Those would have to meet the availability condition in order to qualify as excepted benefits.

Bottom line: If you as an employer do not sponsor a major medical plan, you should not offer a health FSA unless it only provides limited-scope dental or vision benefits. It’s nice to want to offer a health FSA even if you don’t offer medical coverage, or give it to employees who aren’t eligible for medical coverage, but it could mean noncompliance, aka excess taxes and penalties. An alternative benefit is a Lifestyle Spending Account. LSAs are a means for employers to help their employees pay for health and wellness expenses, and sometimes other costs that aren’t typically covered under a group health plan.

Submitting Receipts

There are requirements needed to substantiate health FSA claims, to help ensure that it operates like any other health plan, only paying out legitimate claims.

The person who is administering the plan needs to make sure that everything is in order, otherwise you could be risking the IRS considering all health FSA reimbursements as taxable – whether or not they were properly documented and substantiated.

Health FSA claims must be substantiated with two items:

- Information from an independent third party describing the service or product, as well as the the date of the service or sale, and the amount of the expense

- A statement from the participating employee stating that the medical expense has not been reimbursed and that they will not seek reimbursement for the expense under any other health plan coverage. It should also identify exactly who the expense was for – them, their spouse or any other eligible participant.

Ameriflex Card Swipe Guarantee

With the Ameriflex Card Swipe Guarantee, we work to auto-verify your employees’ transactions so you will not submit documentation. As long as your employees use their debit card for eligible expenses at eligible providers, we do the rest of the work.

What does “independent” really mean?

An “independent” third-party means independent of the employee and the employee’s spouse and dependents. Originals, copies/facsimiles, or scanned copies of originals should satisfy this requirement. Credit card receipts or canceled checks normally do not satisfy the third-party statement requirement.

There is a final requirement, and it mainly affects the FSA administrator, who is responsible for it: independent adjudication. What that means is that the two requirements to substantiate the claim (third-party verification and an employee statement) must be independently reviewed to determine whether all of the requirements for reimbursement have been met.

Need to know how to submit documentation for card transactions (i.e. itemized receipt, EOB, or Orthodontia Claim Form) for a claim? Our help center article gives an explanation of how to complete each step.

The fine print: Every single claim must be independently authenticated – you can’t review only a certain percentage, or automatically approve claims below a certain dollar threshold, or that come from a certain medical provider. You also can’t reimburse a claim based solely on a participant’s promise to follow up with receipts – they must be in-hand in order to authenticate.

Sidebar: Ameriflex has an answer to this authentication issue in its MyPlanConnect program, which reduces the number of substantiation for participants. MyPlanConnect connects your employees’ healthcare FSA charges with their insurance Explanation of Benefits (EOB). Through this integration, it detects when your employees swipe their Ameriflex Debit Mastercard® and automatically matches their purchase with their insurance carrier’s reports. In most cases, MyPlanConnect can verify the eligibility of a claim without the need for your employees to submit supporting documentation.

FSA Example

Flint buys bandages at a convenience store. The receipt shows the date of sale and the amount paid, but there is no description that identifies the purchase as bandages. Flint writes “bandages” and the brand name on the receipt and submits it with his reimbursement claim. The plan must deny Flint’s claim because there is no description of the product from an independent third party.

FSA Example

Shannon submits a reimbursement claim for several expenses during the run-out period under her employer’s health FSA (i.e., after the plan year has ended). Instead of providing third-party information, she attaches a statement describing the expenses and explaining that she inadvertently discarded her receipts. Although the plan administrator has no reason to doubt that the expenses were legitimately incurred, Shannon’s claim must be denied without independent third-party information.

Navigating COBRA

The IRS states that when it comes to COBRA (to the extent that a health FSA is obligated to make COBRA coverage available to a qualified beneficiary) all of the general COBRA rules apply in the same way that they apply to coverage under other group health plans. That includes the rule for how plan limits on how coverage applies to someone receiving COBRA coverage.

Under the generally applicable rules for calculating COBRA premiums, the maximum COBRA premium is the “applicable premium” (generally, the “cost to the plan” for similarly situated beneficiaries who have not experienced a qualifying event), plus 2%. The cost to the plan for a health FSA equals the claims paid to participants plus administrative expenses.

When a health FSA is funded by employee salary reduction contributions or employer credits under a cafeteria plan, the cost to the plan will most often be the amount of health FSA coverage elected by the employees. That means it will amount to the maximum benefit available for the year, because typically, employees tend to incur claims that are around to nearly equal to their elected coverage amounts.

It’s true that year-end forfeitures (fancy word for ‘giving up’) under the use-it-or-lose-it it rule could reduce the cost to the plan below the amount of health FSA coverage elected. However, in many cases this doesn’t happen because forfeitures are used to cover the following:

- To offset experience losses that come up when employees quit, and stop participating in the health FSA in the middle of a plan year — after being reimbursed for medical expenses in excess of year-to-date amounts contributed

- To pay for administration expenses in your plan

- To increase health FSA benefits, decrease health FSA premiums, or provide a cash rebate to participants.

Uniform Coverage

Throughout the coverage period, health FSAs offered through a cafeteria plan are subject to special rules – the first and foremost of those rules is known as the “uniform coverage” rule.

Essentially, the maximum amount of reimbursement for the year must be available at all times during the period of coverage, regardless of how much the employee has contributed so far.

The fine print: A health FSA administrator cannot limit reimbursements according to the employee’s salary reductions or flex credit contributions. Once more, for the people in the back: the maximum amount of reimbursement under a health FSA must be available at all times during the period of coverage, which is generally the 12-month plan year.

What if my employee stops paying the premium?

Simply put, coverage would stop. Health FSA coverage is like insurance. If the employee stops making contributions (paying the premium), then coverage stops. COBRA rights may apply if there is a qualifying event, but the administrator should only reimburse claims that were incurred while the health FSA coverage is actively in force and being paid.

Are there risks with FSAs?

Most employers with health FSAs do not do not experience a combined total loss when evaluating the plan participants’ contributions and forfeitures for the entire year. In fact, most employers have an experience gain (meaning total contributions exceed total reimbursements for the year). With the imposition of the $3200 (indexed) limit on annual health FSA salary reductions, the risk of loss from a health FSA should be reduced even further.

Nonetheless, some employers (particularly smaller ones) are concerned about losses, especially considering the uniform coverage rule. You can address these concerns through various plan designs, a few of which you can see below:

FSA Example

Kathleen participates in her employer’s health FSA. On her enrollment form for the current plan year, she elected $1,800 of health FSA coverage. She resigns effective October 31; by the end of that month, she has contributed $600 to her health FSA account via salary reductions. On her last day of work, Kathleen submits her first-ever claim for reimbursement: a claim to be reimbursed for $1,600 of medical expenses that she incurred for her recent knee surgery.

Does Kathleen need to be reimbursed for the full $1,600, even though she only contributed $600 before ending her employment? Yes, provided that her expenses are adequately substantiated (with independent 3rd party verification and all) and are incurred during the current plan year. The uniform coverage rule causes a health FSA to operate like insurance that provides coverage for a fixed monthly premium — meaning that an employer sponsoring a health FSA must reimburse expenses up to the full amount of a participant’s annual coverage limit ($1,800 in this situation), even if those reimbursements exceed the participant’s year-to-date contributions.

A few options for limiting risk (among many):

Extend the eligibility waiting period: Extending the eligibility waiting period reduces the risk of loss by reducing the number of participants. However, you do have to make sure that when executing this waiting period, it isn’t designed in a way that puts you in violation of non-discrimination rules.

Limit health FSA eligibility to those covered under primary plan: According to Ameriflex’s lawyers, limiting health FSA eligibility to those covered under the primary medical plan is expressly permitted under the 2007 proposed cafeteria plan regulations, and thus a viable option for limiting risk.

Limit categories of medical expenses: Designing a plan that will reimburse some items, while excluding others could result in large expenses early in the plan year. You could also limit or exclude expenses that are more directly controlled by your participants, for example, eyeglasses.

The fine print (AKA what you CAN’T do):

Require repayment of excess reimbursements. Creating a requirement that a participant repay any losses to the plan upon termination of employment would, of course, minimize your risk as an employer – temporarily. In the long run, it’s a direct violation of the uniform coverage rule.

Compliance & What to Do When an Expense Error is Made

It happens to all of us. At Ameriflex, we know what to do when a mistake is made, because they happen all of the time – plan administrators aren’t perfect.

Below are some common mistakes and how to correct them:

Common Mistake #1: Improper reimbursement

What should a plan administrator do after learning that an FSA expense was improperly reimbursed?

Let’s say a reimbursement is given that exceeds the amount of the participant’s annual election. Or a participant has submitted false claims information or received reimbursement under other circumstances involving questionable or improper conduct (tsk tsk). For example, the administrator might learn after reimbursement that a participant had actually obtained a full or partial refund on items or services that were reimbursed by the plan.

Your options for correcting a mistake like this will vary, depending on the terms of the plan, and the circumstances surrounding the error. For example, should the expense have been reimbursed in the first place, or was it correctly reimbursed, but the error is in a misrepresentation by the participant? When it’s discovered – before or after the end of the plan year – can also affect what happens.

It’s not a clear answer, but it is the most effective one: consult with the employee benefits council before deciding how to fix the error. You’ll need an expert to understand how to quickly and properly resolve the issue. However, generally when deciding upon an appropriate correction method, the following issues should be considered:

- Will the proposed correction violate any other provisions of the plan?

- Does the proposed correction require any governmental reporting changes, such as on the employee’s Form W-2?

- If more money must be withheld from the participant’s pay, is enough pay available?

- Can amounts mistakenly paid to the participant be offset from another allowable claim?

Common Mistake #2: Improper reimbursement – error found before year-end

Generally speaking, when an error is discovered during the same plan year that an expense was improperly reimbursed, the process is fairly straightforward. The plan administrator should attempt to correct the error by seeking repayment. However, there are a few ways to go about doing that, depending on your situation.

Either the participant can write a check to the employer (or to the plan, if the plan is funded) in the amount of the mistaken reimbursement, offset the improper reimbursement against future valid health FSA claims, or if properly authorized and allowed under state law, the employer can withhold that amount from the participant’s pay on an after-tax basis.

The fine print: Before withholding from the participant’s pay, you as the employer should ensure that the plan document allows this action and that the withholding will not violate any applicable state wage withholding laws.

The fine print, part two: Whatever steps you take, make sure you apply as much consistency as possible across the program.

FSA Example

Data Info, Inc. maintains a calendar-year cafeteria plan. Miriam, an employee of Data Info, elects health FSA coverage of $1,200 for the plan year. In January, she submits a $100 claim for aromatherapy to her health FSA. Miriam has not received any prior reimbursements from her health FSA. In February, after an expense audit, the plan administrator finds the mistaken reimbursement.

How can Data Info’s mistake be corrected?

There are three possible options:

- Seek repayment of the $100 from Miriam

- Offset the improper reimbursement against future valid health FSA claims

- Treat the reimbursement as business indebtedness and recharacterize it as a taxable benefit (the ‘only if all else fails’ option).

Under the first option, the plan administrator would ask Miriam to repay the $100 to the plan. If Miriam is still employed by the company, the easiest method would be to withhold $100 from her pay on an after-tax basis. If Miriam is no longer employed by her company, she could write a check for $100 to the employer or plan.

Common Mistake #3. Improper reimbursement – error found after year-end

It sometimes happens that improper reimbursements are not found until after the end of the plan year in which they were made. IRS guidance indicates that under these circumstances, the mistaken payment should be treated as business indebtedness. If forgiven, that amount must be included in income and reported as wages on Form W-2 (subject to wage withholding) in the year in which the debt is forgiven.

Common Mistake #4. Denied claim that should have been paid – error found before the run-out period end

So you’ve denied a claim that you find out later is eligible for reimbursement. But the run-out period hasn’t ended! So you’re in luck – the participant should be reimbursed for it, up to the amount available in their account. Not only is it the right thing to do, but you are contractually obligated to reimburse the participant for the valid claim from his or her FSA account.

Common Mistake #5. Denied claim that should have been paid – found after the run-out period ends

So the run-out period has ended, and you find that a claim was denied that should have been paid. Because of the use-it-or-lose-it rule, balances remaining in FSA accounts after the end of the run-out period are forfeited, generally. Which wouldn’t leave FSA funds to reimburse a denied claim that is later determined to be valid. However, where claims are paid from general assets, most employers will allow a pre-tax reimbursement. It can be a good idea to set up a formal plan provision for exceptions to the run-out deadline, to set up a process for an instance like this one.

Admin Q&A with Ameriflex Lawyers

What happens to carryovers if the health FSA is terminated?

Such a plan termination would seem to be no different than the termination of a health FSA without carryovers. In no event should participants in a terminating plan be permitted to cash out their carryovers.

Can a health FSA set a limit on carryovers lower than $640?

Yes. While most health FSAs that add carryovers will allow the maximum permissible carryover amount of $610, plans can also set lower carryover amounts.

How do mid-year election changes affect a participant’s annual coverage limit?

Below are two options for “Cafeteria Plans”:

Option #1: Separate period of coverage approach

This option is best told through an FSA Example: Jon participates in a calendar-year plan. He elects $2,400 of coverage at the beginning of the plan year, with a $200 monthly premium. After three months, Jon decides to change his election. For the remaining nine months, he pays a monthly premium of $100. So, how much coverage does Jon have for the first three months versus the last nine months?

Under the separate period of coverage approach, Jon would have two coverage periods. He would receive $2,400 of coverage for the first three months and $900 of coverage for the last nine months. Under this approach, Jon could be reimbursed for up to $2,400 for claims incurred in February and another $900 for claims incurred in June—a maximum reimbursement amount of $3,300, compared to the $1,500 that John would pay in premiums for the year. But if Jon only incurred $400 of claims during the first three months, his maximum reimbursement amount for the year would be only $1,300 ($400 + $900), compared to the $1,500 that he would pay in premiums for the year.

The fine print: An employee who elected contributions of $0 after a change in status would lose (forfeit) any positive account balance that they had.

Option #2. The blended approach

Many employers don’t follow the separate period of coverage approach. Instead, they opt to use an approach under which there is only one period of coverage, and the initial election and the changed election are “merged” for the coverage period. It’s an approach that seems fairer to the participant and the employer, but it can be complex from the admin’s point of view, depending on how many status changes you have in a year.

FSA Expenses

Carryover vs. a grace period

The first thing to know is that this is a “one or the other” situation. You can’t have your ‘grace period cake’ while eating carryover cash too. If unused amounts are being carried over from one plan year into the next, the health FSA cannot also offer a grace period during the first 2.5 months of the upcoming year. Meaning: employers must decide whether to offer carryovers, a grace period, or neither one. Both carryovers and the grace period have the potential to reduce forfeitures and year-end spending, and to mitigate the difficulty of predicting future medical expenses.

Can “perpetual carryovers” be prevented?

IRS guidance permits employers to limit the availability of carryovers only to people who have elected to participate. You can also require that carryover amounts be forfeited if not used within a specific period of time, such as one year.

HSA eligibility for FSA carryover

Employers can help employees avoid the adverse effect on HSA eligibility of a general-purpose health FSA carryover by amending their cafeteria plans to allow or require that the unused amounts be carried over to any of the following HSA-compatible health FSAs:

- A limited-purpose health FSA (e.g., a health FSA that reimburses only dental, vision, and preventive care expenses)

- A post-deductible health FSA

- A combination limited-purpose and post-deductible health FSA.

The bottom line: if you as any employer offer both an HSA-compatible health FSA and a general-purpose health FSA, you can allow individuals with year-end balances in the general-purpose health FSA (who are also participating in the HSA-compatible plan) to have any unused amounts carried over and applied to the HSA compatible plan.

Electronic payment card programs for health FSAs

The FSA administrator’s life was made a lot easier the day that electronic payment card programs were introduced.

Because this program helps avoid cash flow hardships and streamline administration, many health FSAs allow participants to access funds through electronic payment cards that automatically pay the service provider for eligible medical expenses at the point-of-sale.

These cards usually come in the form of a debit card, stored-value card or credit card. So essentially, your participant would pay for a medical care expense when it occurs, and simply swipe the charge. With it, certain claims can be paid without any substantiation beyond that quick little swipe, thus reducing hassle on the administrative side – for Ameriflex customers, 80% of claims are automated and don’t require any additional documentation.

Is it true that health FSA participants who use electronic payment cards don’t have to submit receipts?

A participant who uses electronic payment cards is not required to submit receipts if their claims qualify for automatic adjudication. However, all other claims must be adjudicated after the fact, which will require participants to provide receipts.

Also, there is no such thing as truly paperless, even if the transaction was “auto-adjudicated.” The IRS requires participants to keep backup documents of all card transactions.

FSA Vocab

A quick review of some of the terms covered above, that you will run into frequently when administering an FSA plan.

What is a ….

Run-out period: If your FSA has a run-out period, your employees will have an extended time at the end of the plan year to submit receipts for reimbursement. The run-out period is usually 90 days after the plan year ends.

Carryover: Thanks to a 2023 rule implemented by the U.S. Treasury Department, FSA participants can carryover up to $640 of their present year election into the next plan year.

Grace Period: A extended period of time at the end of the plan year that would allow participants extra time to incur expenses in order to use up the remaining balance in their FSA account. The grace period is 2.5 months long.

Qualified Reservists: Certain employees who are qualified reservists (called to active duty), allow health FSAs to make some distributions and can be an exception to the use-it-or-lose-it rule.

Independent adjudication: This is the review of the two requirements needed to substantiate a claim (third-party verification and an employee statement) to determine if all of the requirements for reimbursement have been met.

Independent third-party verification: Someone or something independent of the employee (as well as their spouse and dependents) that can verify an expense, i.e. original receipts, copies/facsimiles, or scanned copies of originals.

Automatic adjudication: When using an electronic payment card, the IRS has authorized certain specific situations when it is not required to submit documentation to validate an expense – specifically for participating merchants who have an inventory-based adjudication system.

Benefits of Working with a Third Party Admin

There are a lot of benefits to an FSA, but as you can see from the above, there is also a right and wrong way to navigate it. To help guide you past the risks, as well as save on administrative time and stress, and can be helpful to bring in a third-party administrator.

A third party administrator can bring peace of mind against the intimidation factor of having employees with FSA elections available to use on their card on day one, before any payroll deductions have happened.

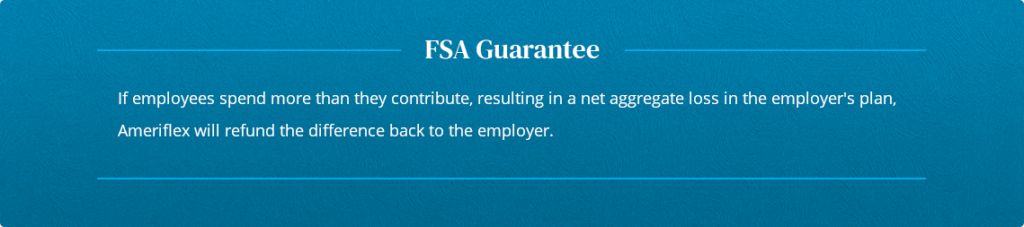

Employer Myth: FSAs don’t come with a guarantee

Many employers can be intimidated by the thought of their employee’s FSA elections being available to use on their card on day one of the plan year, before any payroll deductions have occurred.

There are ways to allay those fears with some knowledgeable help. Ameriflex offers an unmatched FSA Guarantee to ensure that in the event that total annual claims exceed total annual employee contributions, employers have the option to file a claim to recoup the amount of the net aggregate plan year loss.

Ready to take the next step?

Request a proposal or demo to explore the possibilities that await your organization.