Working parents are already aware that childcare costs are rising, and the increasing expense of dependent care is making it harder for employees to pay for childcare in order to work full-time. In August 2023, the Wall Street Journal reported that childcare costs were at nearly twice the rate of inflation, which is in line with the July 2023 report from the Annie E. Casey Foundation that showed childcare costs have risen 220% since the publication of their first KIDS COUNT Data Book in 1990. To help working parents address this issue, Dependent Care FSAs have become a popular tool in helping employers attract and retain top talent. In this Ultimate Guide to Dependent Care FSAs, we’ll explore how these accounts can benefit both employers and employees, offering a vital solution to the rising costs of dependent care.

What is a Dependent Care Flexible Spending Account?

A Dependent Care Flexible Spending Account (DCFSA), also referred to as a Dependent Care Account (DCA), allows employees to set aside pre-tax dollars to pay for dependent care costs such as daycare, after-school care, summer camp, preschool, elder care, and other qualified expenses.

How does a Dependent Care FSA work?

How do employees benefit from a DCFSA?

Every dollar an employee contributes to a DCFSA lowers their taxable income. For example, if an employee earns $40,000 per year with $4,000 set aside for their DCFSA, only $36,000 is taxable.

Savings can add up fast

In this example, a 30% effective tax rate is used to calculate the savings for an annual $5,000 DCFSA contribution.

Daycare $350/month + Summer Day Camp $200 + After School Care $50/month

Savings = $1500

Do employers benefit from a DCFSA?

Employers can improve employee engagement and retention by offering a Dependent Care FSA. In addition to making working parents happier, they can also save money. Since contributions to Dependent Care Accounts are taken out pre-tax, employers don’t pay payroll taxes on the amounts employees contribute to the account.

Lending Tree reported workers are spending an average of 29% of their income on daycare. The financial impact is even greater for those responsible for caring for their aging parents and their children.

Do employees have to participate in the group health plan to take advantage of the DCFSA?

No. Employees are not required to participate in the employer’s health plan to enroll in a DCA.

How much can employees contribute to the account each year?

Each year, the IRS outlines contribution limits for dependent care accounts. The limits are $2,500 for an individual or $5,000 for a family.

Here's a breakdown of DCFSA Contribution Limits:

- $5,000 for single, unmarried individuals

- $5,000 for married couples filing taxes jointly

- $2,500 for married couples filing taxes individually

- All limits are based on the taxable year regardless of the client’s plan year

- For cases in which parents are divorced, only the custodial parent can participate in the DCA

What are the requirements for using a Dependent Care Account (DCFSA)?

- Must be used to pay for the daily care of an eligible child (under 13)

- Adult dependents must be incapable of self-care and reside with the employee.

- Tax-free contributions must enable the employee and/or spouse to be gainfully employed.

- Gainfully employed is described as employed or unemployed but actively seeking work

- An employee whose spouse is a full-time student may also participate in a DCA plan.

- Elections are required to be decided before the beginning of the plan year.

- Changes to elections require a qualifying event.

What happens if the balance isn't used by the end of the plan year?

Funds in a DCFSA are subject to the “use it or lose it” rule. So, the employer needs to clarify terms of the DCFSA to employees. Employers aren’t required to offer a grace period but can choose to offer a grace period that allows employees a 2.5-month window after the plan’s end date in which to spend their remaining balance.

Can employers offer a short plan year?

Short plans are allowed but not back-to-back. A Short plan year has to be followed by a full, 12-month plan year.

Reasons for a short plan year include:

- Employer decides to onboard mid-way through the benefit year

- Employer desires to align benefits according to what their employees need

How does a short plan year work?

An employee joining a short plan year can elect up to the full annual maximum for the plan year.

Annual elections for a short plan year must be prorated based on the employer’s full annual election for a 12-month plan year and the number of months in the short plan year.

Here is a preview of what a full plan year and short plan year might look like:

For a full 12-month plan year January 1 – December 31, an employer normally allows $2500 as an annual max election for an individual or married person filing separately. A short plan year, August 1 – December 31, for example, functions differently.

- $2,500/12 = $208.33/month (Full Plan)

- $208.33*5 = $1041.67 annual max (Short Plan)

When can an employee decide to participate?

Elections can only be made during the open enrollment period unless there is a qualifying event, like a change in employment status, marital status, or number of dependents, etc.

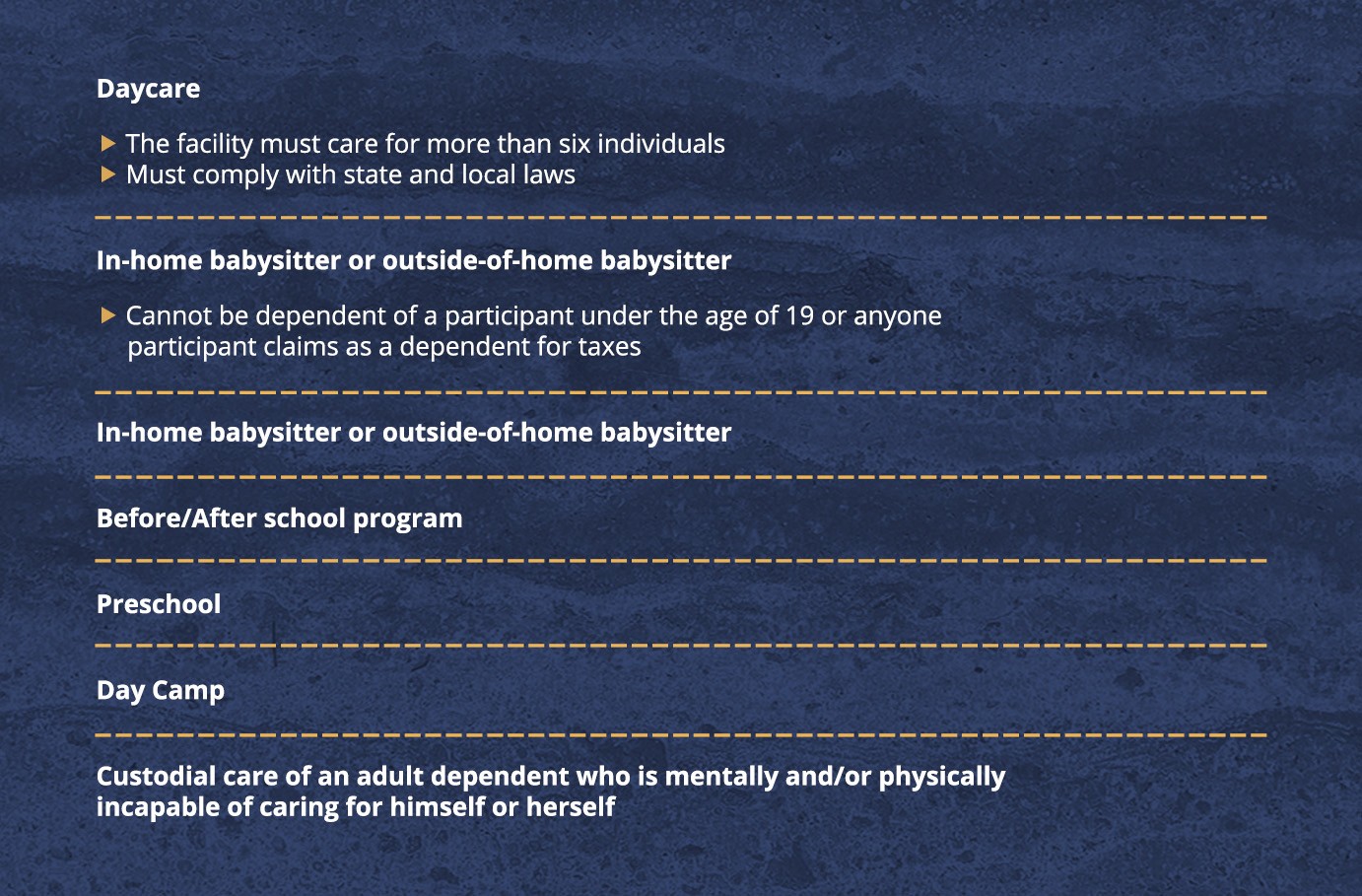

What expenses are considered DCFSA eligible?

What expenses are not covered by a Dependent Care Account?

- Expenses unrelated to custodial care include fees, food, supplies, waiting lists, etc.

- Transportation expenses

- Field trips

- Education tuition fees for Kindergarten and above

- Tutoring programs

- Custodial care that is not used for the express purpose of allowing parents to work and/or attend school

- Payments to spouse or dependent children to take care of dependents

- For adult dependents, any expenses related to medical, nursing care, food/meals

Will using a DCFSA impact the amount I receive on the Child Tax Credit on my taxes?

Using a DCFSA lowers the employee’s taxable income, and a lower taxable income could affect calculations for tax credits, including the Child Tax Credit. Specific circumstances and outcomes will vary by each employee’s circumstance and location.

What if employees need more assistance with childcare than the contribution limits allow?

Employees can only contribute as much as the IRS limits allow. However, in many areas, $5,000 per year won’t cover an employee’s dependent care expenses, especially if they have more than one child. So, employers can choose to supplement childcare expenses with a Lifestyle Spending Account (LSA).

Learn more about LSA options in our Ultimate Guide, or contact our sales team to ask specific questions for your groups.

Dependent Care Flexible Spending Accounts can be valuable to an organization’s benefits strategy. For more information and resources, visit our Open Enrollment Center, Help Center, or reach out to a sales team member to ask questions or get a proposal.