On May 10, 2021, the IRS released the 2022 limits for health savings accounts (HSA) and high-deductible health plans (HDHP).

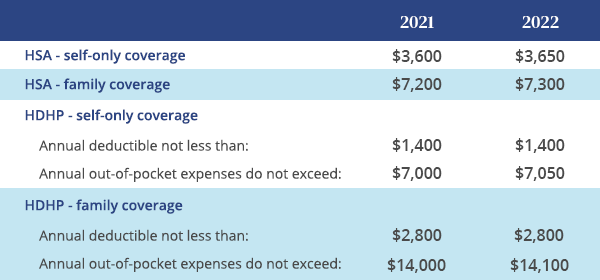

Below is a comparison of the 2021 and 2022 limits for HSAs and HDHPs.

Interested in learning more about Ameriflex’s HSA administration options? Get in touch with our team for more information.