The provisions of the federal COBRA law provide a valuable benefit to employees.

The COBRA acronym is shorthand for the Consolidated Omnibus Budget Reconciliation Act of 1985. It requires employers of 20 or more employees who provide healthcare benefits to offer the option of continuing this coverage to individuals who would otherwise lose their benefits due to termination of employment. If employees are leaving a company, whether voluntarily or for other reasons, they can opt to stay in the company’s health plan for a limited time under this law.

For employees, COBRA is a huge benefit. But it can be cumbersome and complicated for human resource professionals. With COBRA, an employer can face many potential fines, liabilities, and claims issues.

The administration of COBRA can be very difficult. Our country’s healthcare system is perpetually changing, especially in light of COVID-19. Many employers find it close to impossible to manage it all and adhere to the compliance laws of COBRA.

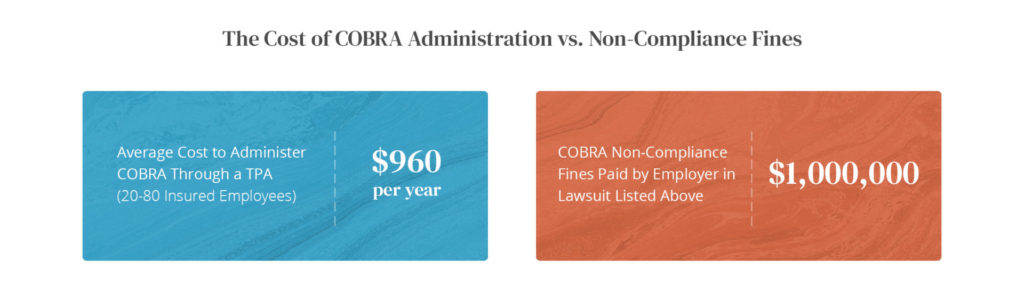

That is why so many companies opt to outsource COBRA continuation of health coverage. Using a third-party administrator (TPA), like Ameriflex, to make sure that a qualified beneficiary has access to COBRA not only helps to ensure that this individual will receive coverage, but it gives the employer peace of mind that they are compliant with federal law.

The benefits of outsourcing COBRA far outweigh the penalties of the burdensome amounts of administrative work COBRA entails, and the cost of fines for non-compliance.

Common Penalties for COBRA Violations

Below are the most common penalties and fines employers and plan administrators can face for COBRA violations.

- IRS Excise Tax Penalty – The excise tax penalty is $100 per day for each qualified beneficiary ($200 per day if more than one family member is affected). The minimum tax levied by the IRS for noncompliance discovered after a notice of examination is $2,500. The maximum tax for “unintentional failures” is the lesser of 10 percent of the amount paid during the preceding tax year by the employer for group health plans, or $500,000.

- DOL ERISA Penalties — An employer is liable up to an additional $110 per day per participant if they fail to provide initial COBRA notices. ERISA can also hold any fiduciary personally liable for non-compliance. An ERISA plan administrator must, upon written request, provide participants and their beneficiaries with copies of documents that they request such as a summary plan document, summary of material modification, annual report, etc. Failure to do so triggers this penalty.

- Failure to Offer COBRA Coverage – Lawsuits could arise under ADA and PHSA for breach of ERISA fiduciary duty and claims for not offering COBRA coverage under ERISA. Within those lawsuits courts can award damages, as well as interest and attorney fees.

- Negligence Claim – An injured qualified beneficiary can file a lawsuit for a negligence claim against the employer.

Real-Life COBRA Lawsuit

Class action lawsuits associated with COBRA have awarded large settlements to the plaintiffs. These plaintiffs have successfully established that their employers had systemic failures to comply with COBRA notice requirements.

Research into COBRA claims revealed the following case of Slipchenko, et. al. v. Brunel et al.

Brunel Energy, Inc. (Brunel) is a Houston-based company that places technical specialists with clients in the oil and gas industry that need staffing for short-term projects.

To do so, Brunel enters into a short-term employment contract with a specialist, and, when the client project is finished, terminates the specialist’s employment. If Brunel hires the specialist to work on another project for the same or a different Brunel client, the specialist and Brunel enter into a new employment contract.

In 2011, a former Brunel employee who participated in the Brunel Group Health Plan (Plan) brought a class action lawsuit alleging COBRA violations; other former employees later joined the lawsuit as named plaintiffs.

This group claimed, on behalf of themselves and similarly situated individuals, that Brunel failed to provide an initial notice when they first became plan participants or an election notice when it terminated their employment. In 2013, the court certified the class action.

Damages would fit within the class action framework, the court determined, because they depend on Brunel’s conduct and intent toward all class members — and not particular individuals. In the same opinion, the court also ruled in favor of two named plaintiffs’ initial notice claims and one named plaintiff’s election notice claim. Following this decision, the parties entered settlement negotiations that resulted in Brunel agreeing to pay $375,000 to the class members along with $625,000 in attorneys’ fees to resolve the dispute.

Because proceeding as a class action significantly increases an employer’s potential liability, class action certification typically plays a key role in an employer’s willingness to settle claims — as well as the amount the company is willing to pay to put an end to the litigation.

7 Benefits of Outsourcing COBRA

Many employers have made the decision to outsource COBRA administration to Ameriflex based on the following seven factors:

- Risk Mitigation

If an employer fails to provide an employee with access to COBRA, or cannot prove that they provided such access, there is no limit to the cost of medical care for which the employer could be found liable. This means you could be on the hook for expensive medical claims well into the future. This is on top of any other governmental fines and excise taxes imposed, which will grow per employee each day. If you outsource COBRA to an experienced administrator, you get the infrastructure, tracking, and controls to protect your business from costly legal challenges. - Lower Administrative Burden and Costs

The main reason you may want to outsource COBRA is to alleviate the administrative burden on your human resources team and to reduce costs. Creating and managing your own system and using your personnel is expensive. An experienced administrator will handle the responsibility, infrastructure, and tracking for COBRA. You will no longer have to create a tracking system for COBRA within your company and making sure that nothing falls through the cracks. You will also save labor costs and free your employees to be able to devote time to their core activities.

- Difficult Personnel Issues Handled by Third Party

When an employee leaves your company, whether voluntarily or involuntarily, some awkward and often emotional issues can follow. You can reduce the chance of having these difficult personnel issues emerge when a third party administers COBRA for you. Employers have also had to face the challenge of keeping a very sick person on the plan, which most HR people would want to do, yet this decision can be financially catastrophic for a company. If you give one person an exception, legally, you have to give other employees the same exception. If you don’t, you could later be sued. COBRA outlines the minimum plans your company must provide, but you can voluntarily offer more. You must treat everyone in the same way to avoid liability.

Is your HR manager going to have the discipline and will to handle that emotional phone call from a COBRA participant who cannot afford the premium, but their child has a heart condition? Will your manager have the ability to take the employee off the plan if your company is no longer legally required to offer continuation coverage?

These are examples of the tough decisions your HR department can face. An experienced TPA can handle this for you and will follow strict rules so that there is an audit trail. They will treat everyone the same and will minimize any conflicts. - Timetables Tracked and Scheduled

Timing is everything in COBRA administration. COBRA plans are the most expensive benefits for your company. Former employees have 60 days to decide whether or not they want COBRA coverage and an extra 45 days to pay the premium. The sooner they receive their COBRA coverage letter in the mail, the sooner the election period begins; and the earlier it starts, the faster it ends, and you have fulfilled your requirements. If you decide to outsource COBRA to Ameriflex, they will mail the COBRA coverage letter the day after receiving the employee’s data. This starts the 60-day period as quickly as possible, every time, saving your company money. - Provide the Right Coverage Information Electronically

A good COBRA administrator can handle the requirements of communicating eligibility and enrollment data to health plans with the same level of care. They can also ensure there is an electronic audit trail. Be cautious, though — many administrators do this manually, increasing the chances of human error and potential risks. If an insurer doesn’t want to cover an employee’s bypass operation, it’s easy for the insurer to claim that they were never told that employee elected COBRA and that your company never put them back on the plan. This is a common occurrence. What Ameriflex does is send COBRA eligibility to health insurance carriers via a secure fax or email in an HIPAA compliant way. Yes, believe it or not, insurance companies still prefer to receive it this way. This also provides an electronic audit trail, with either an electronic fax confirmation or an electronic confirmation that the email hit the recipient’s server. - Interactions with Insurance Companies and Attorneys

If a former employee is making an expensive insurance claim and states that he or she has COBRA Continuation rights, the first thing the insurer will do is to ensure the employer followed all COBRA procedures. If there is any question, the insurer will deny the claim, which means that your company – the employer—is on the hook for the amount until the insurer has had a chance to audit it. By the same token, if a former employee is suing your business, the attorneys will often add a COBRA claim to the suit to make the action more expensive to try, in the effort to force the employer to settle. It only takes an allegation by the employee that “access to COBRA coverage wasn’t provided,” that could make the company liable for fines and taxes from federal regulators. If you want to avoid this kind of difficulty, you should consider outsourcing COBRA. - Peace of Mind for HR Employees

Best of all, outsourcing COBRA administration gives your human resources team peace of mind. They will treat all employees equally. You won’t have to put your human resources employees in a position to remove an employee from COBRA coverage. You won’t have to put your human resources employees in a position where they are forced to remove an employee from COBRA coverage. Your business will also avoid potential legal consequences of non-compliance.

If your clients aren’t taking COBRA seriously, it’s time to partner with Ameriflex. Our team of experts provide the experience and resources needed to ensure COBRA compliance from start to finish. COBRA deadlines for 2022 have been extended; see the details.

Request a demo today to learn how our comprehensive COBRA solution can put your mind at ease.