This week, the IRS released IRS Rev. Proc. 2022-24, which includes the 2023 limits for health savings accounts (HSA) and high-deductible health plans (HDHP).

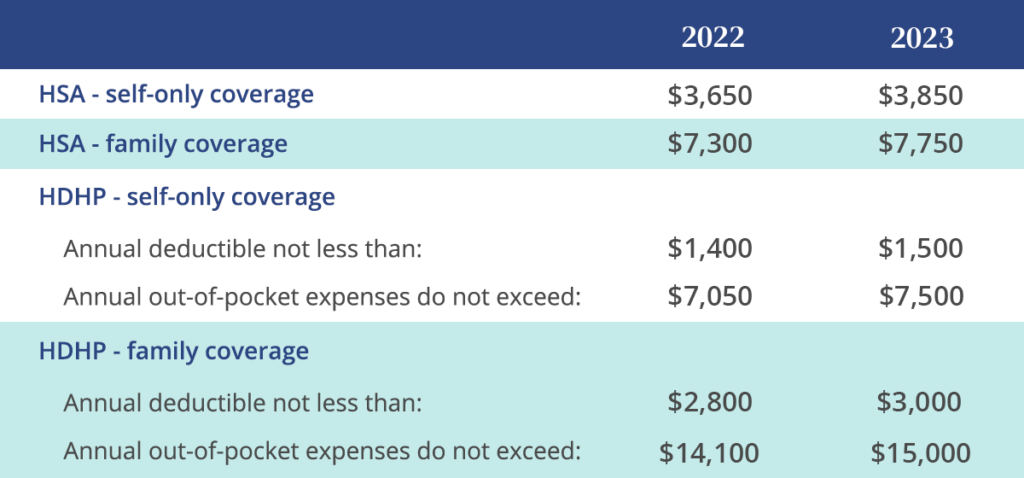

Below is a comparison of the 2022 and 2023 limits for HSAs and HDHPs.

The catch-up contribution limit for HSAs remains at $1,000 for the 2023 plan year.

Interested in learning more about Ameriflex’s HSA administration options? Get in touch with our team for more information.